louisiana inheritance tax waiver form

_____ JUDICIAL DISTRICT I the undersigned affirm and state as follows. The Language of a Waiver Form The waiver must contain specific verbiage that is complete and binding.

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005.

. For current information please consult your legal counsel or. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property.

Do you need a waiver for inheritance in Ohio. Succession is accepted unconditionally but see LA RS. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary.

Estate transfer taxAn estate transfer tax return. It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. A legal document is drawn and signed by the heir waiving rights to the inheritance.

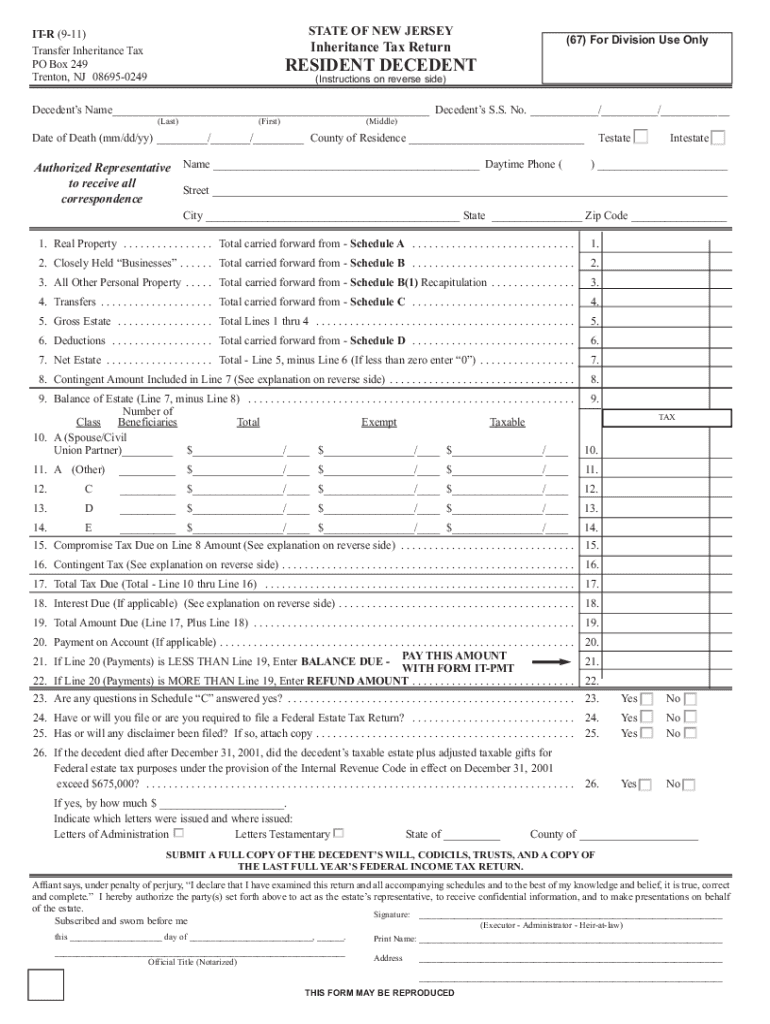

1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions 4 Total amount due Add Lines 1 through 3 5 Previous remittance 6 Balance due or refund requested Subtract Line 5 from Line 4 Name Designation and Social Security Number. Federal law eliminated the state death tax credit effective January 1 2005. Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher-itance tax is due or the value of the deceaseds estate is 15000 or more LSA-RS.

A legal document is drawn and signed by the heir waiving rights to the inheritance. Louisiana provides five alternatives to the judicial succession process. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

The heir and the deceased individual must be identified by name. In this context small means less than 75000. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

As of the spring of 2011 the district of columbia and 34 states do not require an inheritance tax waiver be prepared. Do you have to pay taxes on inherited money in Virginia. Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur after December 31 2004. As soon as youve completed the Maryland Application by Foreign Personal Representative to Set Inheritance Tax give it. Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws.

Print out the document and complete it with youryour businesss information. In 2018 that exemption was fixed at 11 million dollars for an individual and 22 million dollars for a married couple. Download the template in the format you require Word or PDF.

The tax begins when the combined transfer exceeds the unified exemption. All groups and messages. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Ohio Waiver required if decedent was a legal resident of Ohio. This right is called a usufruct and the person who inherits this right is called a usufructuary. This form covers the death of the second spouse to die.

Virginia does not have an inheritance tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. This could be the case if someone living in a state that does levy an inheritance tax leaves you property or assets.

Louisiana Inheritance Tax WaiverAn inheritance tax is one thats imposed on heirs when they receive assets from a deceased persons estate. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Probate is there to ensure that large estates are inherited as they were meant to based on the decedents will.

There is a chance though that you may owe inheritance taxes to another state. These alternatives apply only in very specific circumstances. Louisiana Inheritance and Gift Tax.

A Louisiana Inheritance Tax Return would also be needed in most cases and in some cases a federal Estate Tax Return will be required. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less. For instance Kentuckys inheritance tax applies to any property in the state even if the.

Social Security numbers of heirs are shown in the affidavit of valuation. What is an inheritance tax waiver in NJ. 18 518 Main St.

LOUISIANA SMALL ESTATE AFFIDAVIT Louisiana law allows the transfer of the assets of a small succession by affidavit without a formal court proceeding. Louisiana does not have an inheritance tax. What is a inheritance tax waiver form.

What is inheritance tax waiver form. Box 29 Wainwright AK 99782 T 9077632989 F 9077632926 Email. Missouri also does not have an inheritance tax.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

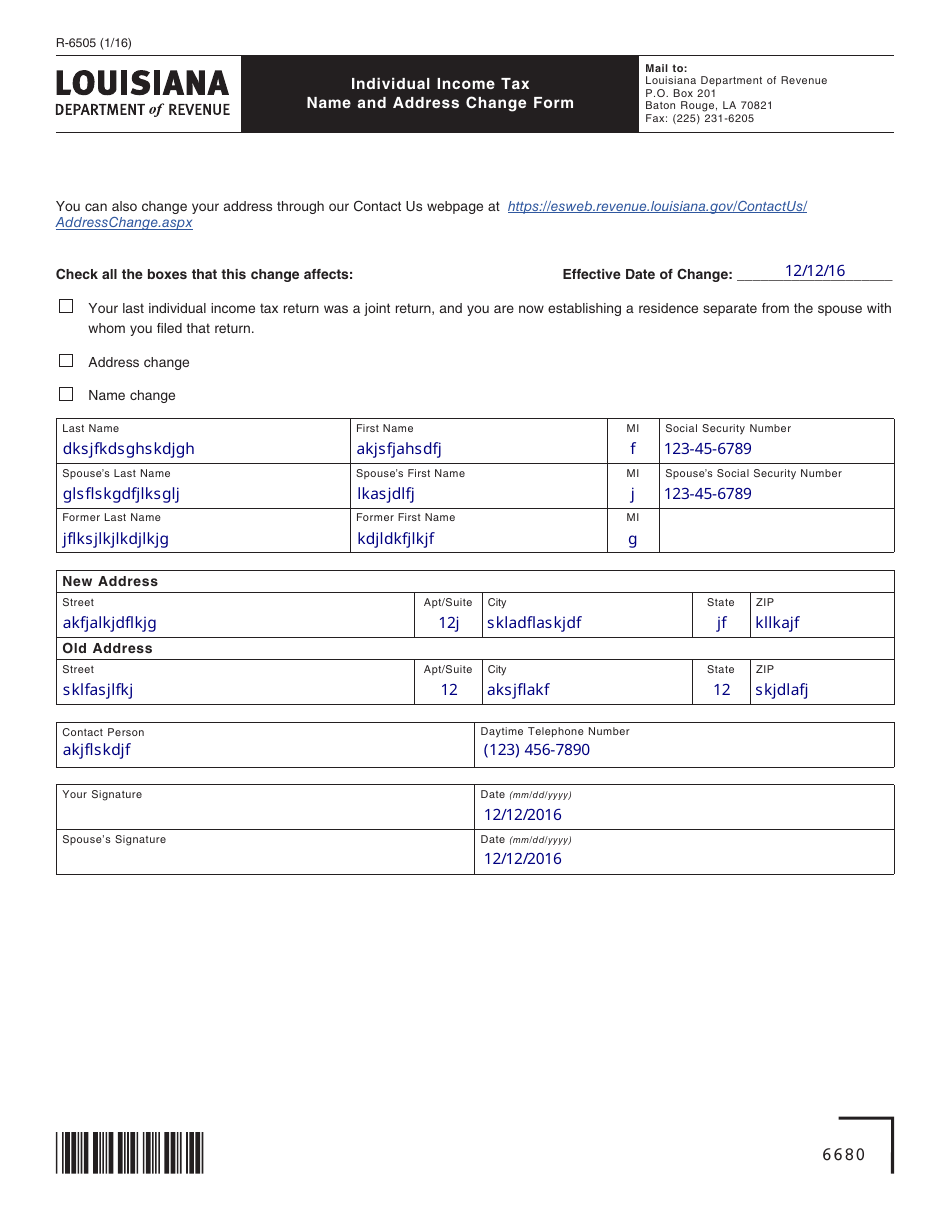

Form R 6505 Download Fillable Pdf Or Fill Online Individual Income Tax Name And Address Change Form Louisiana Templateroller

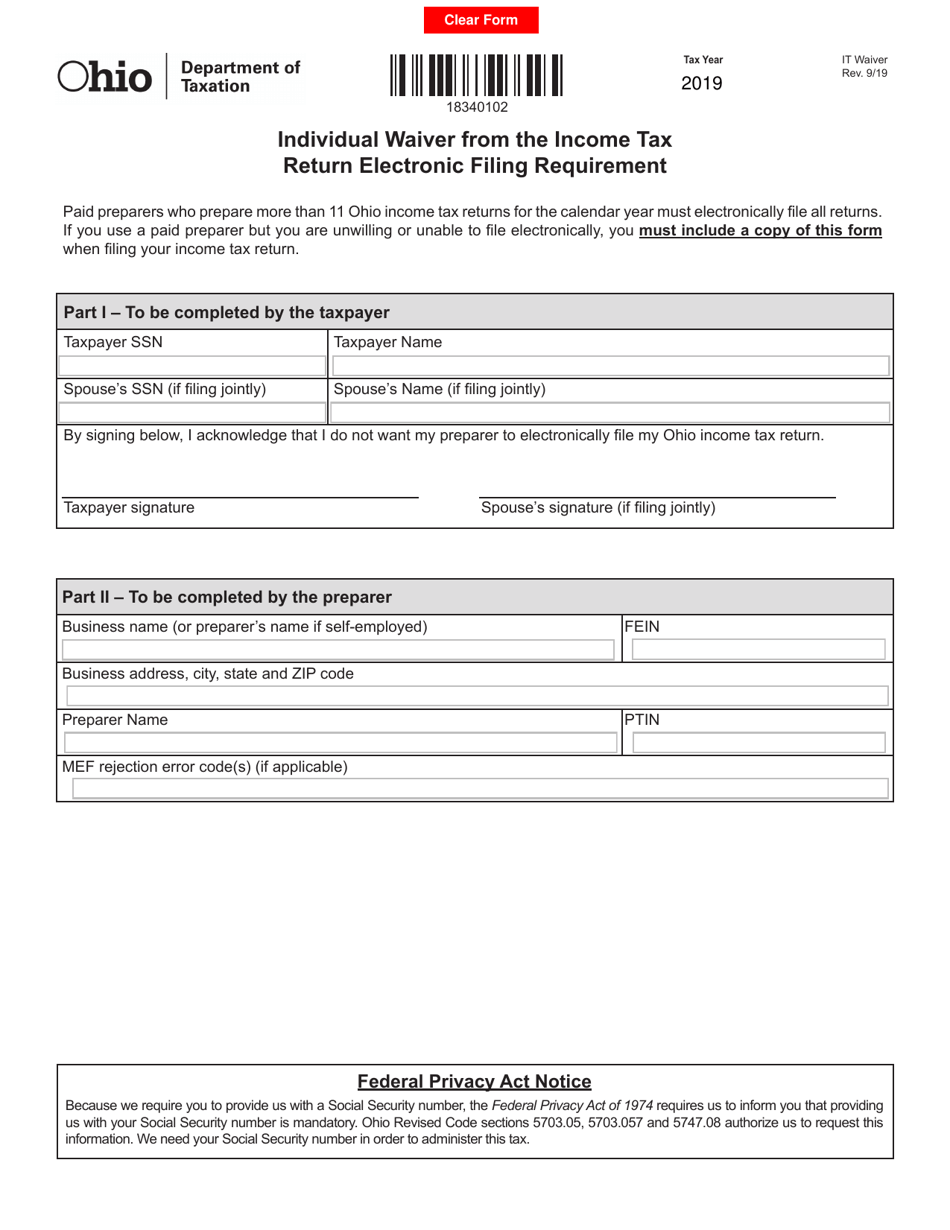

Form It Waiver Download Fillable Pdf Or Fill Online Individual Waiver From The Income Tax Return Electronic Filing Requirement Ohio Templateroller

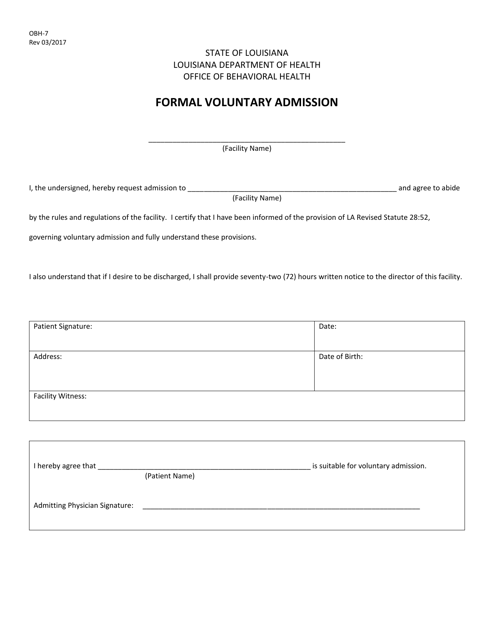

Form Obh 7 Download Printable Pdf Or Fill Online Formal Voluntary Admission Louisiana Templateroller

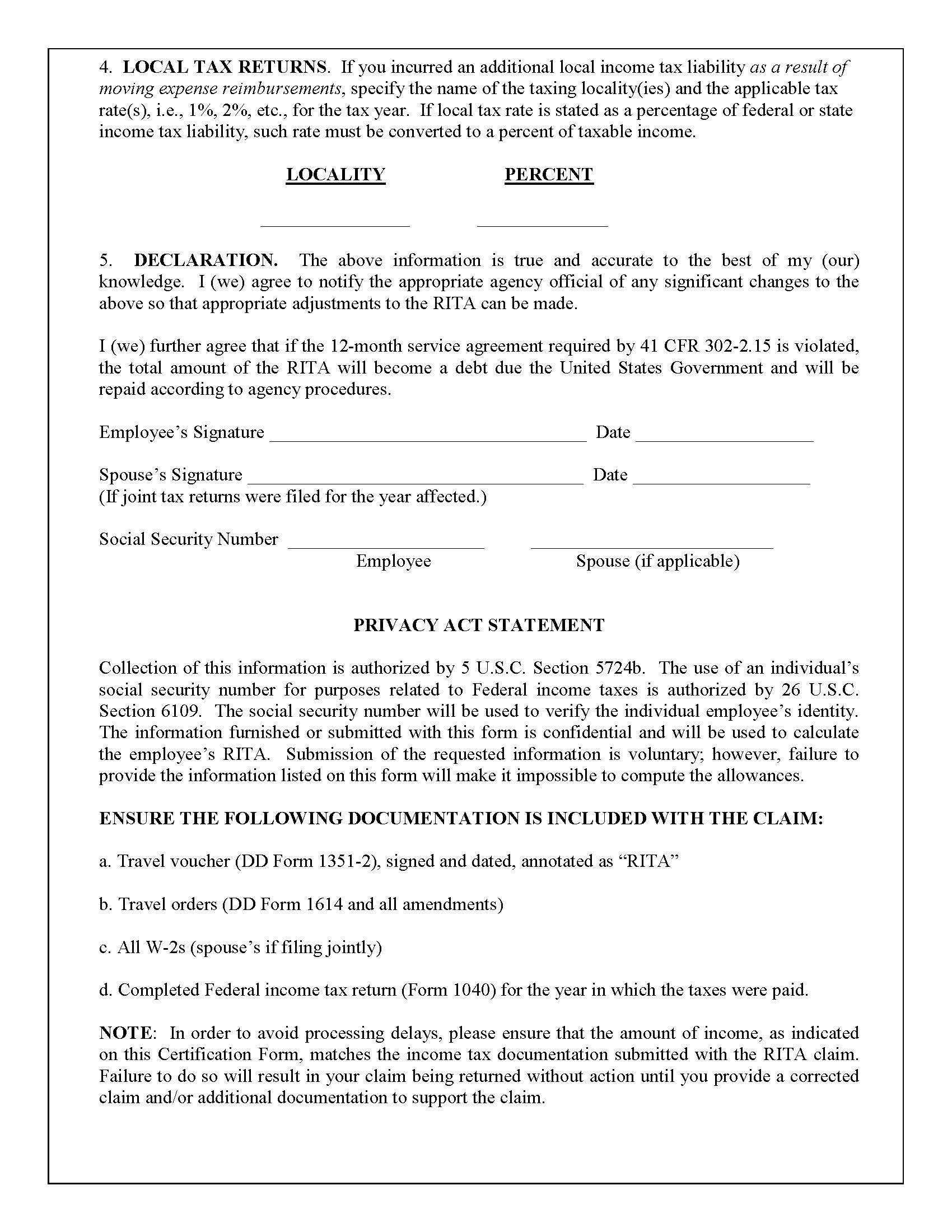

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

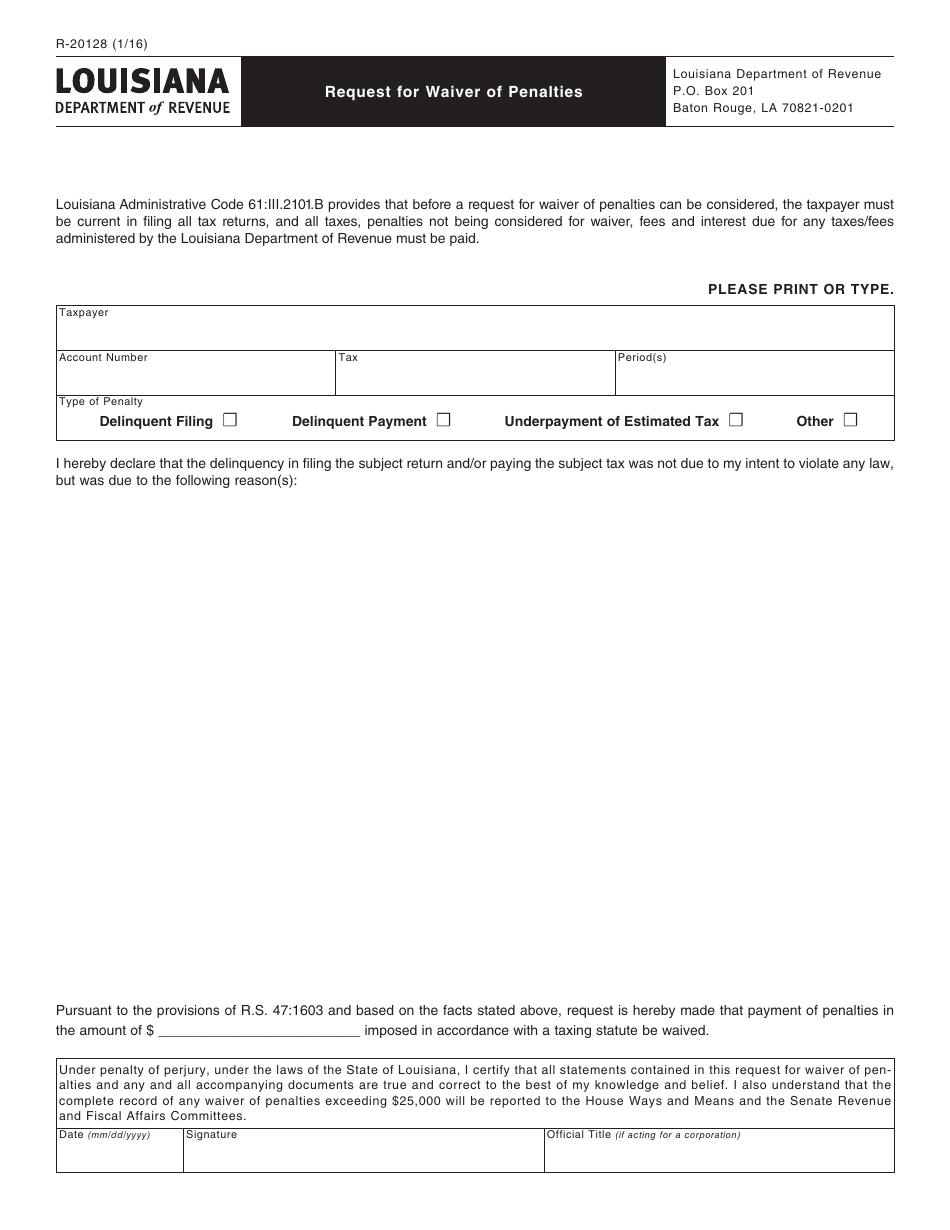

Form R 20128 Download Fillable Pdf Or Fill Online Request For Waiver Of Penalties Louisiana Templateroller

Free Direct Deposit Authorization Form Pdf Word Eforms

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut

Free Rent Landlord Verification Form Word Pdf Eforms

Louisiana Inheritance Tax Estate Tax And Gift Tax

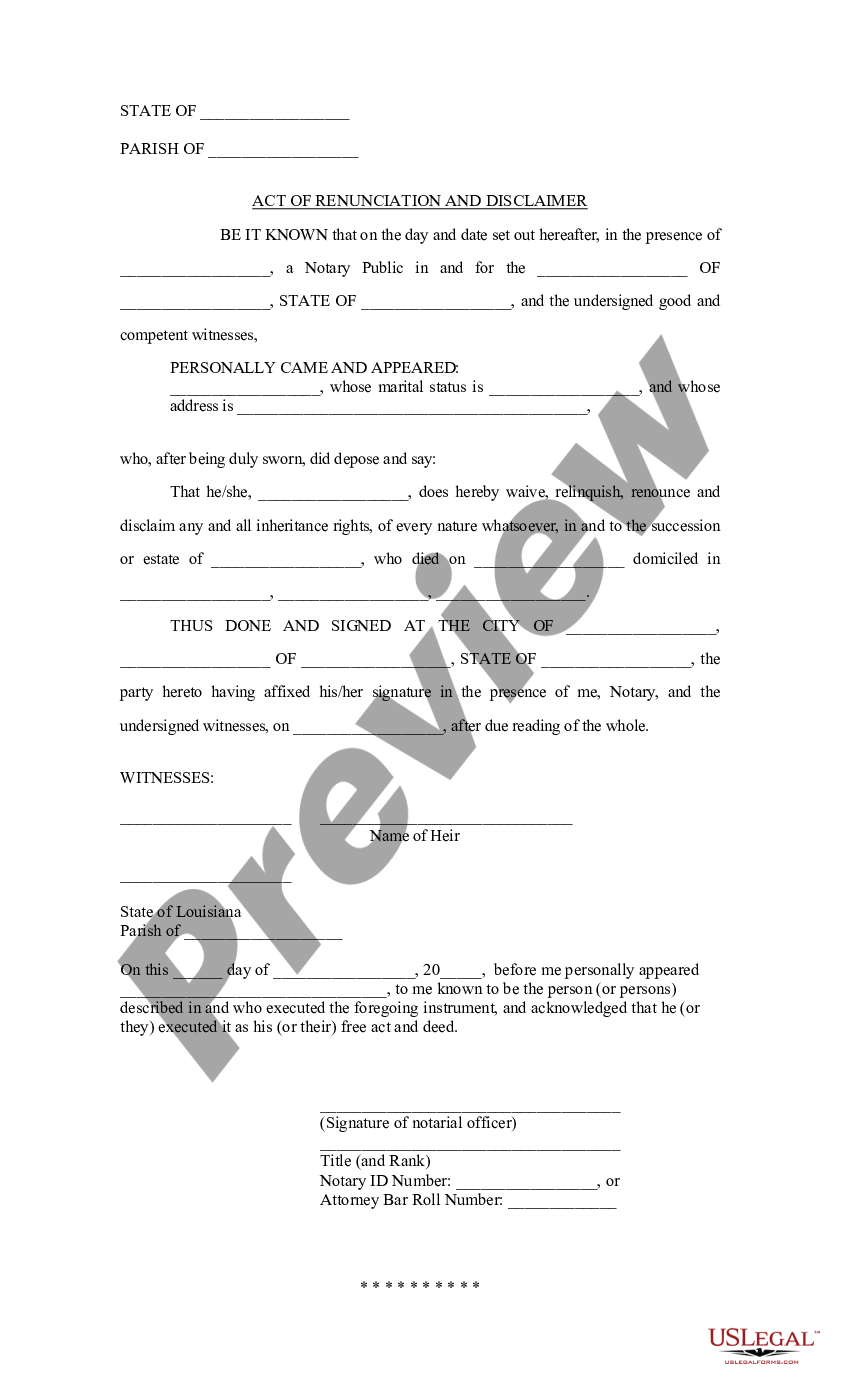

Louisiana Act Of Renunciation And Disclaimer Renunciation Disclaimer Renunciation Us Legal Forms

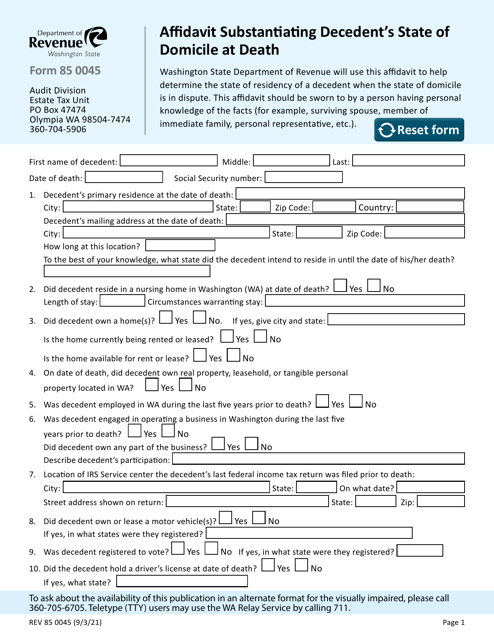

Form Rev85 0045 Download Fillable Pdf Or Fill Online Affidavit Substantiating Decedent S State Of Domicile At Death Washington Templateroller

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms