north carolina estate tax return

The decedent and their estate are separate taxable entities. If the return cannot be filed by the due date the fiduciary may apply for an automatic six-month extension of time to file the return.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

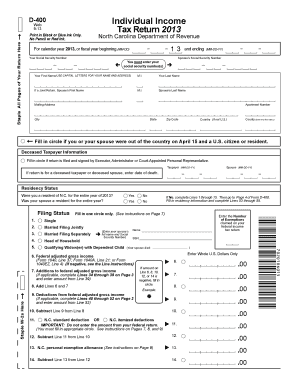

31 2021 can be prepared online via eFile along with a Federal or IRS Individual Tax Return or you can learn how to complete and file only a NC state returnThe latest deadline for e-filing NC State Tax Returns is April 18 2022.

. Then print and file the form. North Carolina does not collect an inheritance tax or an estate tax. General Tax Return Information.

They could file using Form 1120 which is a traditional corporate method. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Department of Revenue Offers Relief in Response to COVID-19 Outbreak Notice.

Owner or Beneficiarys Share of NC. According to North Carolina Instructions for Form D-401 if you are a North Carolina resident you must file a North Carolina tax return if your minimum gross income exceeds the amount allowed for your filing status. The departments general information number is 1-877-252-3052.

PDF 33221 KB - January 04 2021. North Carolina is currently delayed in issuing guidance for. North Carolina Estate Tax.

Form 706 Federal Estate Tax Return. North Carolina encourages but does not. Complete this version using your computer to enter the required information.

Collected from the entire web and summarized to include only the most important parts of it. North carolina estate tax return. The North Carolina Department of Revenue administers tax laws and collects taxes in the state of North Carolina.

North Carolina doesnt charge an estate tax or an inheritance tax at the state level. Application for Extension D-410P for Filing Partnership Estate or Trust Tax Return Web 8-19 Instructions Purpose - Use Form D-410P to ask for 6 more months to file the North Carolina Partnership Income Tax Return Form D-403 or the North Carolina Estates and Trusts Income Tax Return Form D-407. North Carolina COAs and HOAs have two options to file their tax returns.

Federal Estate Tax. North Carolina Estate Tax. Impact of Session Law 2022-06 on North Carolina Individual and Corporate Income Tax Returns COVID-19 Updates.

Estates and Trusts Fiduciary. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022. Does North Carolina Have an Inheritance or Estate Tax.

North Carolina Gift Tax History. Last week the North Carolina House Finance Committee approved repeal of the states death tax. Houses 4 days ago Federal Estate Tax.

The states governor appoints the secretary of revenue who heads the department. Important Notice Regarding North Carolinas Recently Enacted Pass-Through Entity Tax New Important Notice. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. Recently we wrote about North Carolina potentially joining several other states that are repealing state estate tax or death tax. More on Money.

Link is external 2021. An estate or trust that is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file the corresponding North Carolina income tax return. Due Date - Individual Returns - April 15 Extensions - To request a six month extension file Form D-410 Application for Extension for Filing Individual Income Tax Return by April 15The form can be e-filed or it can be completed online here.

While there isnt an estate tax in North Carolina the federal estate tax may still apply. Your North Carolina State Individual Tax Return for Tax Year 2021 January 1 - Dec. Theres also a number for inquiries into individual tax refunds.

The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. Application for Extension for Filing Estate or Trust Tax Return. Form 8971 Information Regarding Beneficiaries Acquiring Property From a Decedent.

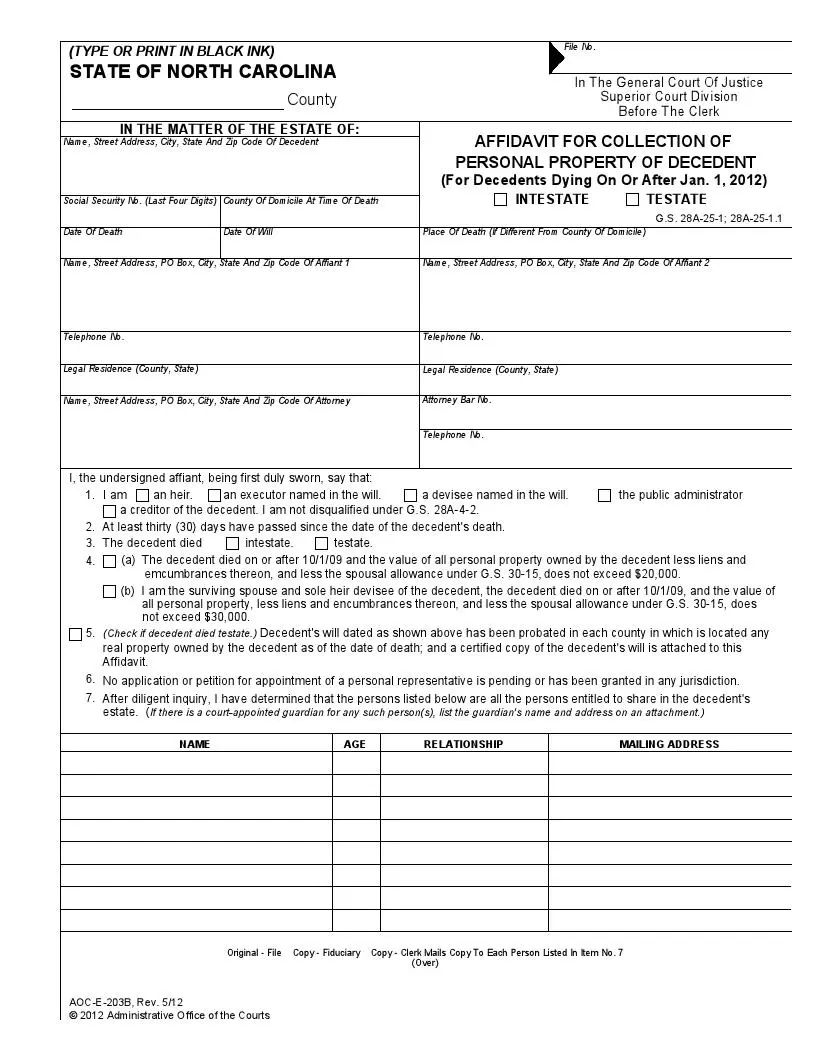

While there isnt an estate tax in North Carolina the federal estate tax may still apply. Inventory for Decedents Estate Form AOC-E-505. Drivers LicenseGovernment Issued Photo Identification.

Reopen the estate after probate is closed Notice to beneficiaries that they are named in a will. IRS Form 1041 US. Form 1041 Income Tax Return for Estates.

What are the filing requirements for Residents. Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. As a result certain important tax questions arise.

File income tax returns. Beneficiarys Share of North Carolina Income Adjustments and Credits. Year tax return or 100 percent of the tax on the prior year returnYou.

North Carolina property tax rates range from a low of 042 percent in Watauga County to a high of 122 percent in Durham County. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to deduct from adjusted gross income either the North Carolina standard deduction amount or the North Carolina itemized deduction amount. Form 1120 is flexible with the expense allocation as it does not require HOAs to maintain the 90 rule and has a lower tax rate of 15 tax rate for the first 50000 of their taxable income.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. An estates tax ID number is called an employer identification. Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax.

You may also need to file an income tax return for the estate. North Carolina Estate and Inheritance Taxes. Can be used as content for research and analysis.

The estate will need its own tax identification number if sets up an estate checking account or if there. If you are not required to file a federal return but meet the filing requirements for North Carolina you must fill out a. The North Carolina General Assembly approved eliminating the states tax on military pension income in the fiscal budget that was.

However state residents should remember to take into account the federal estate tax if their estate or the estate. Before we get into the nitty-gritty of gift taxes lets define what a gift actually is in the eyes of the IRSA gift is basically anything of value that you transfer to another individual or entity without expecting anything of. Everything You Need to Know.

NC K-1 Supplemental Schedule. 6 Things Every Homeowner Should Know About Property Taxes. Youll need to file a final income tax return for the decedent.

North Carolina Estate Tax Everything You Need To Know Smartasset

Free North Carolina Small Estate Affidavit Form Pdf Formspal

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

What Is A Charitable Remainder Trust Carolina Family Estate Planning

North Carolina State Tax Information Support

State Employees Credit Union Tax Refund Information

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina State Taxes 2022 Tax Season Forbes Advisor

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

North Carolina Income 2021 2022 Nc Forms Refund Status

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

North Carolina Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

North Carolina Estate Tax Everything You Need To Know Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Nc Tax Forms Pdf Fill Online Printable Fillable Blank Pdffiller

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog